Understanding DSO: the good, the bad and the ugly

In the famous spaghetti western, the characters must work somehow together to get the treasure they are searching for. No one would be able to accomplish alone. Each one has different knowledge of where the money is....

In the business world there is one KPI for sales collections that works apparently in a vacuum: DSO. It is really DSO the best metric to give an all encompassing view of accounts receivable, one of the largest assets in your business?

Short answer: no!

DEFINITION

Days Sales Outstanding (DSO) is a well known method to evaluate how effective a company is at collecting receivables. It is used to measure the average number of days it takes a company to collect invoices after a sale has been made.

It is beyond doubt that how quickly you collect accounts receivable has a direct impact on your cash flow, and that has a huge impact in the whole company´s evolution as the cash can be reinvested back into the business.

problem is... the ratio is biased and does not provide good information to management, we will see it.

CALCULATION

Typical formula:

(Accounts Receivable/Annual revenue) X Number of Days in the Year.

INTERPRETATION

As a well know KPI, a controller or CFO will look at this number as a way to determine how well the AR department is doing their job. Even you can you can apply the DSO calculation at the customer level to get an idea of their ability to pay and therefore categorize it as risky business.

Each industry has different standard payment terms but in general we could say that:

- A low DSO means that a company is collecting receivables quickly; generally this is a positive sign.

- A high DSO proves that a company takes longer to collect on credit sales and can indicate customer´s cash flow problems, operational issues, or a lack of effort on credit collections.

How can you try to reduce the DSO? A few options are implementing specific accounts receivable management software, changing credit terms, or running more in depth customer analysis before extending commercial credit to customers.

Ideally DSO should not exceed your terms by more than half. (i.e. payment terms of 30 days and DSO of 45)

however....

WHATS WRONG WITH DSO?

Most CFOs, CEOs and boards are looking towards this key DSO metric to decide whether the AR/Credit department is performing well.

Unfortunately for the AR department, this key metric is extremely flawed and usually creates a bad reflection on what was actually collected: since the calculation for DSO typically includes the total amount sold and annual figures, this overlooks many factors the go into the accounts receivable department and affect how they collect.

SALES INPUT and SEASONALITY

As the metric includes granted payment terms, it might be that sales negotiation stretch the terms beyond standard for big customers/amounts.

Calculation takes in consideration sales for a period versus AR at one moment. If sales are not regular or customers tend to pay on a specific day, DSO will give a wrong image.

DSO counts only credit sales, not cash sales, being those a huge success of the credit department (cash payments = no risk) !

THEN WHAT?

You should combine DSO with other KPIs to ensure that all factors are accounted for and you get a clear view of AR:

# AVERAGE DAYS LATE

Meaning...how many and how late are invoices paid past their due date. Is better to see it in buckets: 15 days late, 30 days , 60 days and so on. And check if those customers with high percentage of open AR in the late buckets are still receiving credit and why.

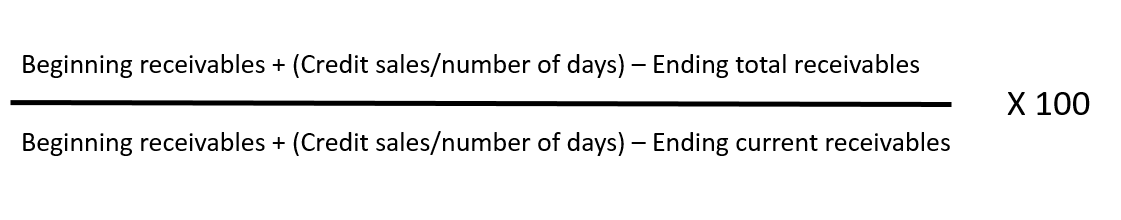

# COLLECTION EFFECTIVENESS INDEX - CIE

This KPI looks at what can be collected because it is actually due. 100 is the perfect score that can go even better if invoices are paid before they come due.

Typical formula:

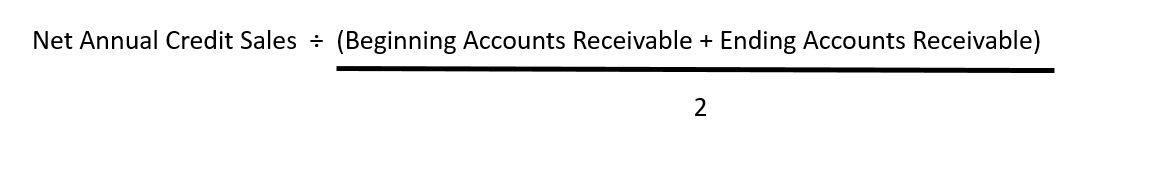

# ACCOUNTS RECEIVABLE TURNOVER RATIO

Number of times annually that the credit collection department collects its average AR.

If ratio is high means an effective credit policy and collecting

Typical formula:

CONCLUSION

In most of the companies the Accounts Receivable account is either the 1st or 2nd largest asset of your business, so it deserves the proper attention.

What you really need to get a GOOD AR Ratio is combine the UGLY CIE and the BAD DSO to get a correct view of how the credit and collections department is really performing and identify those customers or processes that are really dragging down you cash performance.

More on DSO: http://ift.tt/1UJdGMf

comments powered by Disqus