O2C and RPA, a path of discovery

O2C, RPA ... sounds like a StarWars robot right? Well, they are not so far far away for your galaxy!

The order-to-cash (O2C) is one of those company processes that can either make or break your business. How you manage it has a direct impact on customer satisfaction, cash flow, and employee´s happiness.

On the other hand, it is not a simple as many people think. The breadth of the O2C process makes it one of the hardest processes to track and optimize....! What means it´s a big opportunity for improvements!

let´s roll with the basis:

What is an order-to-cash?

The purpose is clear: to deliver goods/services ordered to a customer in exchange for cash. Typical example:

Order creation - Fulfillment - Shipping - Invoicing - Payment

Simple? well, reality is never this straightforward! Think of extra steps (like goods issue, delivery, clearing, cash a check. There are millions of transactions that cross departments making really difficult to get an overview of the process, so ...lets try to simplify it: O2C consists of two main parts: Order management and Cash receivable , with slightly different goals each (the goals of order management might be improving the order rate, on time shipping or order fulfillment cycle time... while the goals of accounts receivable include reducing overdue payments and DSO days sales outstanding )

Challenges

In the O2C process, these two sides rely heavily on each other. Order management can’t achieve true efficiency without the support of accounts receivable and vice versa. However, the teams driving these two parts of the process sometimes end up working in silos which does not lend itself to an efficient process.

Sure, you have thought on other common challenges in the O2C like:

- Manual order entry leading to high rate of error rates and resulting in costly and time-consuming rework

- Poorly maintained customer master data

- Issues withdelivery or returned goods, influencing customer retention rates

- High DSO rate (many times due to above reasons), impacting cash flow and missed opportunity for investments

So, how can we improve such a complex process like O2C? Well, it is perfect for using process mining to find automation potential.

Process mining

Process mining connects directly to the systems that interface with the O2C process, such as Oracle, or SAP and other ERP systems. Using an in-built data transformation layer, the technology transforms data into a process graph that chronicles the entire process from start to finish. It captures all process variations, bottlenecks, rework , and exceptions.

With process mining, you can see exactly what happened in the process, figure out why it happened, and work on a plan of action to improve it.

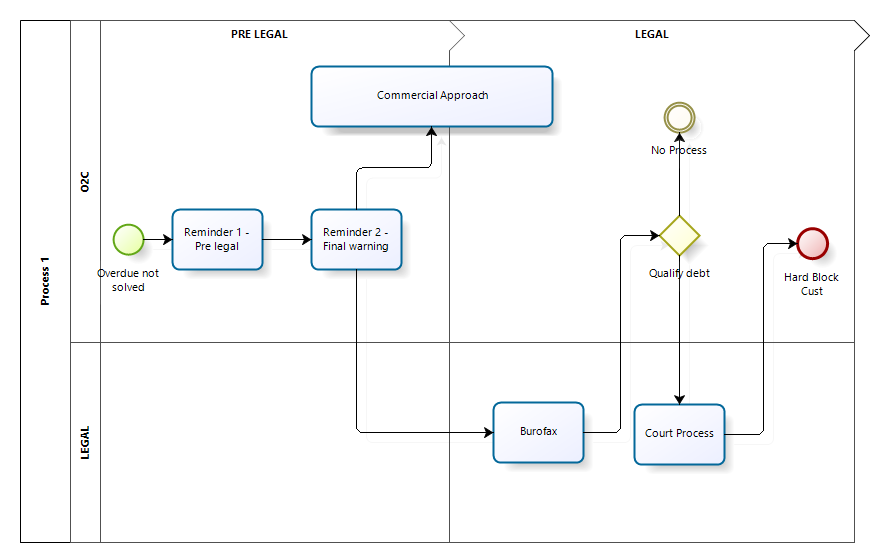

(A manual approach like the picture below it gives you an overview that it might be enough for quick gains)

Automate as possible

Process mining will tell you undiscovered automation potential in your processes. The quickest way to automate is using RPA (Robotic process automation) for those small iterative tasks that delay the whole system. You might have discovered for instance that certain customer requires a confirmation of delivery slip and that its a manual work donde at collections moment. using RPA the slip will be sent automatically to the define email just in time for payment.

Control and Iterate

Once you have done a few steps with RPA, use process mining again to track results and ensure that automation is reaching the expected goal.

Conclusion

There is always room for improvement in any business process and O2C is a key chain that deserves your continuous attention.

Do you feel process mining or RPA are too complex for you? or maybe there are intended only for those big companies? ....,think twice and get in touch with an expert to review your process. You will be surprised! and cash will flow again!

comments powered by Disqus